Catherine Austin Fitt’s Solari recently published a guide to inform US Lawmakers newly elected in 2024 how to go about the business of Reversing the Financial Coup.[1]

In my humble opinion an important detail was omitted : the economics of Government Deficit Spending. I outline here the economic argument and some recent US financial data.

The economic case is opened in 1908 by Jerome Levy who progressively analyses over 100 transaction types and as a small business owner, he had an interest in evaluating potential changes in profits caused by changes in the economy. Michal Kalecki followed a different route a generation later, eventually setting out, in 1969, an Economic Identity : The General Case Profit Equation. (GCPE) [2]

The political outlook of these two men differed, but they had the same goal. They wanted to create the greatest good from the least input. They lived in a different financial world, but their equation still holds.

GCPE == Investment – Savings + Export Surplus + Capital Consumption + Deficit

I could argue that in the long run, Savings = Investment; that eventually exports and Imports must balance; and Capital Consumption can be a rounding error. I need not make that effort. Given the state of finance extant in the USA right now, I can restate the above equation thus :

Corporate Profits == Government Deficit Spending

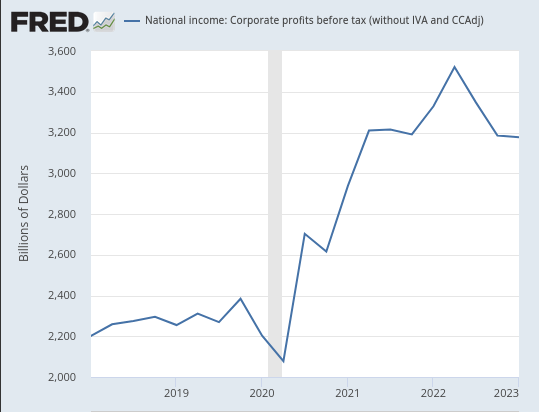

To assess the truth of that statement I offer the following financial data for the exceptional 2020 year. Note that 2021 had similar financial excesses.

All figures in US$ Trillions (2020 fiscal year) :

US GDP : 20.9

US Deficit spending : 3.2

And 5-year quarterly data from the St Louis Fed Table A053RC1Q027SBEA

DATE,A053RC1Q027SBEA

2018-01-01,2202.037

2018-04-01,2258.834

2018-07-01,2274.868

2018-10-01,2295.174

2019-01-01,2254.933

2019-04-01,2311.3

2019-07-01,2269.075

2019-10-01,2383.929

2020-01-01,2202.657

2020-04-01,2078.07

2020-07-01,2702.715

2020-10-01,2615.907

2021-01-01,2937.989

2021-04-01,3209.367

2021-07-01,3214.189

2021-10-01,3190.746

2022-01-01,3328.491

2022-04-01,3521.785

2022-07-01,3347.843

2022-10-01,3185.64

2023-01-01,3176.76

The above figures show the annualised rate of Corporate Profits before tax. The chart below suggests that corporate reporting delays the appearance of profits in their accounts by some six months. [3]

To tidy up a loose end or two here, note that that is being said is that when Corporate Profits before tax exactly equal Government Deficit Spending, then all other components of the Profit Equation must sum to zero. That opens up a host of questions, but I will not detract from the central theme of this post.

Absent evidence to the contrary, understand that a dollar increase in Government Deficit Spending is another dollar removed from the pocket of a taxpayer and added to the Profit of the Corporate Sector. Modern Monetary Theory would have you believe that these things are unimportant.

I can only add that I never fail to be surprised to hear how people can look at the same facts and reach diametrically opposed conclusions. Such is life.

[1] Reversing the Financial Coup

https://audio.solari.com/Solari_Papers/SolariPapers-1-v5.pdf

[2] Jerome Levy Economic Institute : Working paper No 309

https://www.levyinstitute.org/pubs/wp309.pdf

[3] https://fred.stlouisfed.org/series/W987RC1Q027SBEA